Economic conditions keep changing thus I have implemented two calculation methods for Benjamin Graham’s Intrinsic Value model. Both methods, Fixed and Custom, use the same formula.

- Fixed: This method implements Benjamin Graham’s Intrinsic value formula (revised version). Use this method if you don’t want to make any customization

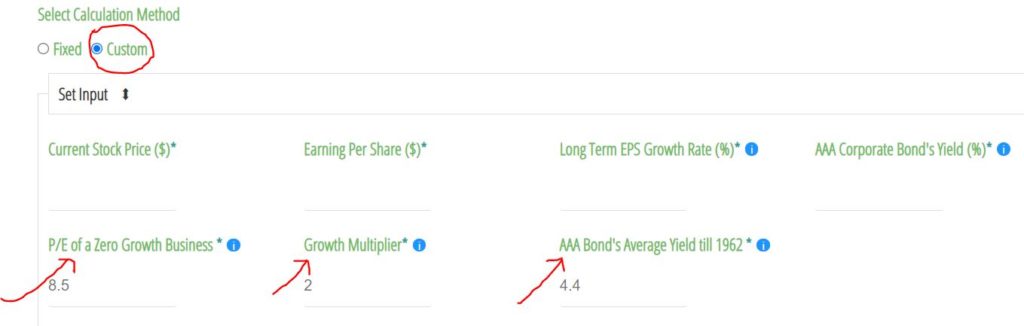

- Custom: This method allows you to customize the parameters of the Intrinsic value formula. You can create many scenarios to simulate different economic conditions and calculate the intrinsic value of a stock in that economic condition.

Graham’s Intrinsic Value User Guide with Demo

What is Intrinsic Value?

A business is a productive asset, and stock represents a part of that business. The intrinsic value of a productive asset is the sum of all its future profits that is discounted at an appropriate rate to calculate the asset’s present value. You can use Capital Asset Pricing Model (CAPM) to calculate the discount rate. Find how to calculate the appropriate discount rate using our CAPM calculator.

What is the formula used in Graham’s Intrinsic Value calculator?

The “Fixed” method in our intrinsic value calculator executes the revised formula found in Graham’s book, The Intelligent Investor.

Just set the values in the required fields of our calculator and it will give you the intrinsic value of the stock. It will also calculate the margin of safety with respect to the current stock price. In my calculator, I used the revised version of Graham’s formula.

What do the parameters of Graham’s Intrinsic Value formula represent?

- EPS (Earning Per Share): You need to enter the EPS value of the trailing twelve months (TTM).

- G (Growth Rate): G here means the Growth rate of the EPS. You need to input the estimated average future growth rate of the EPS. This growth rate is not the next year’s growth rate. It is the average of the estimated growth over the next 7-10 years.

- 2 (Growth Multiplier): Graham used 2 as the growth multiplier based on the median business growth of his time period.

- 4.4 (AAA Bond Yield till 1962): This parameter represents the AAA Corporate Bond’s Yield till 1962. The average Yield of the USA’s AAA Corporate bond was 4.4%.

- 8.5 (Fair P/E of Non-Growth Business): This parameter represents the fair Price to Earning (P/E) ratio of a zero growth stock. According to Graham, 8.5 is the fair P/E ratio of a no-growth company.

- Y (Current AAA Bond Yield): Y represents the current Yield of AAA Corporate Bond’s Yield. The yield keeps changing, so use the most recent value. This rate can vary a lot based on the country. So, always use the correct countries’ rates. If you don’t use the correct yield then you will be very wrong in your intrinsic value calculation. The table below shows USA AAA Corporate bonds yields over the last 5 years, you can find it on FRED Website

| Year | USA AAA Corporate bond Yield |

| December 2016 | 4.06% |

| December 2017 | 3.51% |

| December 2018 | 4.02% |

| December 2019 | 3.01% |

| December 2020 | 2.26% |

| August 2021 | 2.55% |

Do we need to change/customize Benjamin Graham’s Intrinsic Value formula?

Benjamin Graham recognizes the long-term changes of the market and economic conditions. For those reasons, he revised his original formula. Benjamin Graham’s original Intrinsic Value calculation formula was as follows:

He recognizes different market condition requires a different set of parameters and values. The changes are dynamic so the calculator must be dynamic too. That is exactly the reason for me to implement the “Custom” calculation method in Graham’s intrinsic value calculator.

How to customize the parameters of Benjamin Graham’s Intrinsic Value formula?

If you select the “Custom” calculation method in the calculator, you will have the option to customize the following 3 parameters Graham’s Intrinsic Value formula

- Growth Multiplier

- P/E of a Zero Growth Business

- AAA Bond’s Average Yield (%) till 1962

Growth Multiplier customization

In Graham’s revised Intrinsic Value Formula, he used 2 as the growth multiplier. In my opinion, the Growth multiplier should be based on the growth of the business. You should use a range between 0-2 for a more accurate Intrinsic Value calculation.

If you want to be aggressive use a higher value and if you want to be conservative, you should use a lower value for the growth multiplier. For example, for a business that is growing 20-30% per year (i.e. Facebook, Google, Microsoft, etc. ) you should use a lower multiplier than 2. Personally, I generally use the following customization

| Growth Multiplier Value | When to use it | Valuation Type |

| 2 | Stable Mature Company | Aggressive Valuation |

| 1.5 | Stable Mature Company | Reasonable Valuation |

| 1 | Stable Mature Company | Conservative Valuation |

| 1 or Less | Hight Growth Company (i.e. EPS growth 20%+) | Reasonable Valuation |

P/E of a Zero Growth Business customization

Graham used P/E=8.5 as the fair value of a non-growth company. Today we have close to zero or even negative rates in some countries. You should use a value range for the P/E of a no-growth business depending on the risk-free interest rate.

P/E=8.5 is very aggressive for low-interest conditions. You can use a value between 6.0 – 8.5. Use 6.0 for conservative and 8.5 for aggressive valuation. I customize the P/E of a Zero growth business based on the current risk-free rate (10-year Treasury bond yield) as following

| P/E of Zero Growth | When to use the customized Value |

| P/E = 6.0 – 6.5 | Use when the risk-free rate is 2.5% or less |

| P/E = 6.5 – 7.0 | Use when the risk-free rate is between 2.5 – 3.5% |

| P/E = 7.0 – 8.5 | Use when the risk-free rate is higher than 3.5%+ |

AAA Bond’s Average Yield (%) till 1962 customization

Graham used 4.4% in his formula because until 1962 the average yield of AAA-rated corporate bonds in the USA was 4.4%. AAA bond’s rate can be very different if you are outside of the USA.

In developing countries like Bangladesh or India, AAA bonds’ yield could be 7.5 – 8.0% due to their high inflation. Find the historical AAA-rated corporate bond’s yield of the market where the business is primarily operating.

How would I customize Graham’s Intrinsic Value formula for 2021 market conditions?

The placeholder values are the numbers used by Graham. The economic conditions are dynamic and change all the time. Set the values according to the current or near-future conditions and calculate a more accurate intrinsic value of the stock.

Based on the 2021 USA market condition, for most of the business/stock, I use the following version of Graham’s Intrinsic value formula

Stock’s Fair / Intrinsic value calculation examples using Graham’s formula

I used morningstar.com as the data source for both companies’ fundamentals, date 2021, September. Sometimes, you will not find all data exactly the way you need them. You may need to calculate by yourself.

In table 2 above, I gave you my general customization for the Growth Multiplier of Graham’s formula. I do not use the same number for each stock. I break down the growth multiplier’s values based on the stock’s growth rate.

Facebook (High Growth) Stock’s Fair value using Graham’s Intrinsic value formula

I am using Facebook as an example of a high-growth company. Let us calculate facebook’s fair value using Grahamäs original intrinsic value formula and my customization. We can compare the results to understand how the market is currently valuing Facebook.

Facebook Stock’s Fundamentals:

- EPS (TTM): 11.68 USD

- Future (7-10Y) EPS Growth: 25%

In 2018 Facebook’s EPS was 7.57 and in 2021(TTM) it is 11.68. The average growth is about 35%. In my opinion, It will be difficult for Facebook to grow at that rate. A growth rate of 25% could be achievable.

Facebook’s EPS growth rate is more than 30% thus I used 0.75 as the growth multiplier.

Let’s keep Graham’s original Intrinsic value formula and my custom version of the formula side by side. It will be easier to see the difference.

Graham’s Intrinsic Value Formula (Original) for Facebook

Graham’s Intrinsic Value Formula (My Customization) for Facebook

| Graham’s Formula | P/E of No-Growth stock | Growth Multiplier | AAA bond’s yield | Intrinsic Value | Market Price |

| Original | 8.5 | 2 | 2.8% | 1073.73 | 376.5 |

| My Customization | 6.5 | 0.75 | 2.8% | 463 | 376.5 |

Facebook stock’s fair value is 1074 USD based on Graham’s intrinsic value formula which is 186% higher than the market price (376.5 USD). This indicates that Graham’s method is not most suitable for high-growth companies in today’s market conditions.

My customization for facebook gives an intrinsic value of 463 USD which is 23% higher than the actual market price (376.5 USD). This indicates that the market does agree on Facebook’s annualized growth rate will be as high as 25%.

JnJ (Slow Growth) Stock’s Fair value using Graham’s Intrinsic value formula

I am using johnson & johnson (JnJ) as an example of a slow-growth company. Let us calculate JnJ’s fair value using Graham’s original intrinsic value formula and my customization. We can compare the results to understand how the market is currently valuing JnJ.

JnJ Stock’s Fundamentals:

- EPS: 5.66 USD

- Future (7-10Y) EPS Growth: 2%

In 2018 J&J EPS was 5.61 and in 2021(TTM) it is 5.66. The average growth is about 0.1%. In my opinion, JnJ can grow or at least maintain the 0.1% rate. They have more room to grow.

I used a 2% growth rate for JnJ because they have pricing power. Their revenue growth is about 2%

I used 1.5 as the growth multiplier for JnJ because JnJ has stable quality earning, has pricing power, and an AAA credit rating.

Let’s keep Graham’s original Intrinsic value formula and my custom version of the formula side by side. It will be easier to see the difference.

Graham’s Intrinsic Value Formula (Original) for JnJ

Graham’s Intrinsic Value Formula (My Customization) for JnJ

| Graham’s Formula | P/E of No-Growth stock | Growth Multiplier | AAA bond’s yield | Intrinsic Value | Market Price |

| Original | 8.5 | 2 | 2.8% | 111.18 | 164.5 |

| My Customization | 6.5 | 1.5 | 2.8% | 84.50 | 164.5 |

JnJ stock’s fair value is 111.18 USD based on Graham’s intrinsic value formula which is much lower than the market price (164.5 USD).

My customization for JnJ gives an intrinsic value of 84.5 USD which is even lower.

This may indicate that currently JnJ stock is very popular and a lot of investors are buying it regardless of what is its intrinsic value. The market can be exuberant and miss price stock in the short term.

Use your own judgment and rationale when you calculate the intrinsic value of a stock.

Why you should buy Stocks with a large Margin of Safety?

You can see that the market can be very irrational and the price of a stock can be very different from the intrinsic value of the stock. That is why you should buy a stock below its intrinsic value. You should always pay 20-30% lower than the intrinsic value of the stock.

Over the long term, stock price trades around its intrinsic value. So, a good Margin of Safety will often give you a good return on your money.

You can also see that Benjamin Graham’s formula can give a wide range of intrinsic values depending on the parameter you use. So, use the appropriate value that represents the economic and/or business condition.

What are the limitations of Benjamin Graham’s Intrinsic Value?

Graham’s Intrinsic value formula is a very good and powerful tool. You must use it carefully and customize the parameters to get more accurate results. Graham’s Intrinsic value method has some limitations. I mentioned a few as follows:

- Can not calculate intrinsic value if Earnings Per Share (EPS) is negative. One year a business may have negative earning that does not automatically means the intrinsic value of that business is negative. You can use the last few year’s mean or median of the EPS if a stock has negative EPS for a year.

- Graham’s Intrinsic value formula is very aggressive for 2021 market conditions

- Graham’s Intrinsic value formula is very aggressive for high growth stocks

- Do not take the business broader business fundamentals. Only earnings and earnings growth do not always give a complete picture of the underlying business.

More Intrinsic Value Calculators

You should always use more than one valuation method to determine a more accurate value of a stock. To help you with your financial independence journey, I developed a few more Intrinsic value calculators, link below

- Benjamin Graham’s Number

- Peter Lynch Valuation Model

- Multistage Dividend Discount Model

- Discounted Cashflow Model (DCF)

Who is Benjamin Graham?

Benjamin Graham is often referred to as “the father of value investing“. Graham is famous for his ability to pick undervalued stocks. Warren Buffet is one of his students. Warren Buffet in his early career worked in Benjamin Graham’s Investment firm, Graham-Newman Partnership.

Later in Graham’s career, he took a teaching position at UCLA Anderson School of Management at the University of California, Los Angeles. Graham’s two popular published books are as follows

- The Intelligent Investor

- Security Analysis

He is also popular for giving us some very wise quotes on value investing.

In the short run, the market is a voting machine but in the long run, it is a weighing machine

Benjamin Graham

If you are shopping for common stocks, choose them the way you would buy groceries, not the way you would buy perfume.

Benjamin Graham