Peter Lynch’s method for stock fair value calculation is suitable for high-growth companies. Peter Lynch’s fair value formula is a simple ratio that gives an indication of a stock’s valuation range.

What is the Peter Lynch’s Fair Value Formula?

Peter Lynch’s Fair value is based on the PEGY ratio. He inverted the PEGY ratio to make the valuation of a stock. Based on the value of Lynch’s Fair Value ratio, he determines the valuation of the stock. Below is Peter Lynch’s Fair Value Formula, you can find it in his book “One up on Wall Street”, page 199. He gave an example and explained with coca-cola stock

IIf a company’s growth rate (including dividend yield) is equal to its Price-to-Earning ratio, Lynch’s fair value ratio will be equal to 1. According to Peter Lynch, Ratio value = 1 means that the stock is trading at a fair valuation.

Peter Lynch gave us his interpretation of the fair value ratio is as follows:

| Peter Lynch’s fair value | Interpretation of Peter Lynch’s fair value |

| Value is less than 1 | Stock is Over-Valued |

| Value is equal to 1 | Stock is Fairly-Valued |

| Value is equal to 2 | Stock is Under-Valued |

| Value is more than 3 | Stock is VERY Under-Valued |

You can see that Peter Lynch’s value calculation does not give an exact intrinsic value of a stock. The value of the ratio gives an indication of the current valuation measure of a stock.

What do the parameters of Peter Lynch’s Fair Value Represent?

- Earnings Growths Rate: Use the estimated future long term growth. You can take an average of the next 3-5 years Earnings-per-share (EPS) growth rate. You can use the last 5-10 years’ average earnings growth rate If you can not find a good future estimate

- Dividend Yield: Use the latest dividend yield. Divide the latest annual cash dividend per share by the share price and you will the dividend yield.

- Price-to-Earning (P/E): Divide the stock price by EPS and you will get the P/E ratio.

What changes did I make to Peter Lynch’s fair value?

Peter Lynch interprets his fair value ratio with a large range. There are no steps for the value < 1, meaning that all stocks below 1 are equally over-valued. A step between 0 and 1 could make the interpretations more accurate.

Further, it is not clear how to interpret when the value = 1.5? Is it Fairly-Valued or Under-Valued?

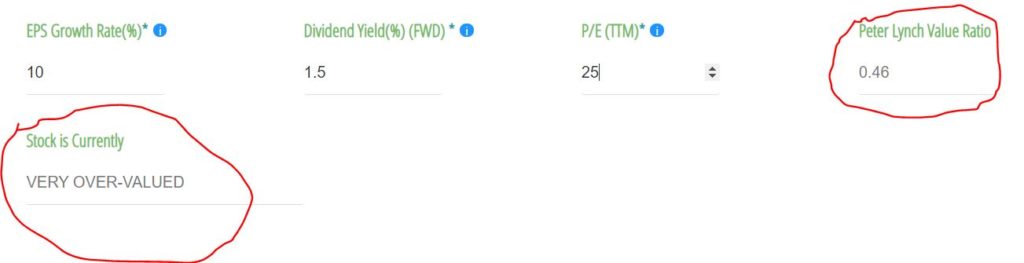

To make a more accurate interpretation of his fair value ratio, I added an extra step for Lynch’s values below 1. In my interpretation, if the value is less than 0.5, I call it VERY Over-Valued

I have clarified what it means when the lynch’s fair value is 1.5. In my calculator lynch’s value between 1- 2 is Fair-Value.

The below table shows my added step and interpretation of Peter Lynch’s fair value

| Peter Lynch’s fair value | Interpretation of Peter Lynch’s fair value |

| Value is less than 0.5 | Stock is VERY Over-Valued |

| Value is between 0.5 and 1 | Stock is Over-Valued |

| Value is between 1 and 2 | Stock is Fairly-Valued |

| Value is between 2 and 3 | Stock is Under-Valued |

| Value is more than 3 | Stock is VERY Under-Valued |

What is Peter Lynch’s Formula based on?

Peter Lynch Fair Value formula is based on the Dividend Adjusted PEG ratio. Another name for the Dividend Adjusted PEG ratio is the PEGY Ratio.

Based on the value of the PEGY ratio, you can derive the valuation of stock as follows

| The PEGY Ratio Value | Interpretation of the PEGY Ratio |

| Value is less than 1 | Stock is Over-Valued |

| Value is between 1 and 2 | Stock is Fairly-Valued |

| Value is more than 2 | Stock is Under-valued |

Stock’s fair value calculations examples using Peter Lynch’s Method?

I use both Yahoo Finance and Morningstar as the data source of all companies’ fundamentals. Data represent the value as it is at 2021, August. I mentioned earlier how you can calculate the necessary parameters of Peter Lynch’s formula by yourself.

Values used for each parameter are as follows:

- Next 5 Years (per annum) EPS growth rate .

- I use GAPP Trailing Twelve Month P/E. If the company reports net loss or split operations, I use Non-GAPP Trailing Twelve Month P/E

- Forward Dividend Yield

High growth company’s valuation using Peter Lynch’s Method?

| Company Name | EPS Growth | Dividend Yield | Tailing P/E | Lynch’s Ratio | Stocks Valuation |

| 28.60% | 0% | 28.01 | 1.02 | Fairly-Valued | |

| 24.41% | 0% | 31.40 | 0.78 | Over-Valued | |

| Microsoft | 15.25% | 0.75% | 37.11 | 0.43 | Very Over-Valued |

| Amazon | 35.77% | 0% | 61.15 | 0.62 | Over-Valued |

Low growth company’s valuation using Peter Lynch’s Method?

| Company Name | EPS Growth | Dividend Yield | Tailing P/E | Lynch’s Ratio | Stocks Valuation |

| JnJ | 8.89% | 2.46% | 25.83 | 0.44 | Very Over-Valued |

| Altria | 4.67% | 7.09% | 20.67 | 0.67 | Over-Valued |

| AT&T | 2.70% | 7.55% | 8.51 | 1.21 | Fairly-Valued |

| Merck & Company | 12.77% | 3.42% | 13.17 | 1.24 | Fairly-Valued |

When to Buy/Sell based on Lynch’s Fair Value?

You should buy and own a stock forever unless the fundamentals of the business change. The ideal time to buy a stock is when it is VERY Under-Valued and the ideal time to sell could be when it is VERY over-valued.

If you can not find VERY under-valued stocks then go for under-valued. Try to avoid buying a stock when it is VERY over-valued.

What are the limitations of Peter Lynch’s fair value calculations?

Peter Lynch’s fair value calculation is a very quick and easy way to do a stock valuation. It is a very powerful method as any beginner can use it. It has some limitations as follows

- Does not calculate an exact intrinsic value

- The broader fundamentals of a business are not under consideration

- Tends to underestimate slow growing companies

More Intrinsic Value Calculators

You should not base your investment decision only based on Peter Lynch’s fair value method rather, use it as an indication to investigate further.

You should always use more than one valuation method to determine a more accurate value of a stock. To help you with your financial independence journey, I developed a few more Intrinsic value calculators, link below

- Benjamin Graham’s Intrinsic Value

- Benjamin Graham’s Number

- Multistage Dividend Discount Model

- Discounted Cashflow Model (DCF)

Who is Peter Lynch?

Peter Lynch is an American value investor, mutual fund manager, author, and philanthropist. He worked as a fund manager at Magellan Fund at Fidelity Investments between 1977 and 1990.

Lynch’s Magellan Fund averaged a 29.2% annual return, making it the best-performing mutual fund in the world. During his 13-year running the fund, assets under management increased from US$18 million to $14 billion.

Peter Lynch’s two popular published books are as follows

- One up on Wall Street

- Beating the Street

An interesting fact about Peter Lynch is that he retired at the age of 46. His father at the age of 46.

He is also popular for giving us some very wise quotes on value investing.

The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them. Stand by your stocks as long as the fundamental story of the company hasn’t changed

Peter Lynch

Know what you own, and know why you own it

Peter Lynch

Key to making money in stocks is not to get scared out of them

Peter Lynch