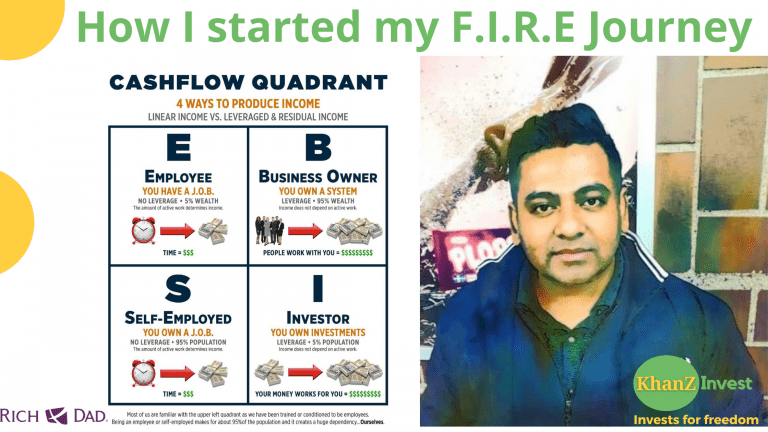

We all know the proverb, “Health is wealth”. Having good virtues makes us even wealthier. Today we will only talk about finance and money as wealth. I have an unfair advantage over most people. I have been an (E)employee, (S)elf-employed, (B)business owner, and (I)investor. In the book “Rich Dad’s Cashflow Quadrant: Guide to Financial Freedom”, author Robert Kiyosaki told us how each E/S/B/I makes money in a different way. He missed one more Quadrant, (U)unemployed, I have been that too. This Quadrant is a very special one, usually brings no income but surely brings a lot of extra pieces of baggage…!

I am writing this note to keep reminding me that life will bring changes; nothing is permanent. To move forward, we must keep evolving. There is a saying (paraphrasing), “If you are born poor it’s not your fault but If you die poor thats your fault”. I think the message is trying to tell us that we are responsible for the life we have/build for ourselves.

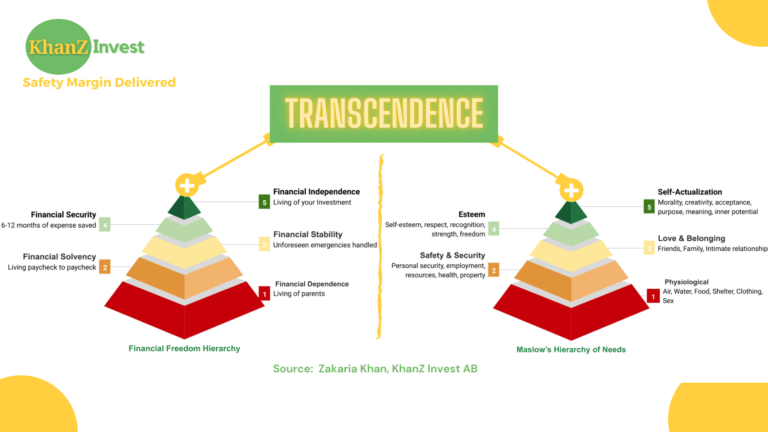

Unlike Robert Kiyosaki, I believe that a Quadrant does not define who we are and we are not limited to that. Nothing is stopping an employee (active income earner) to make passive income. Similarly, an Investor (passive income earner) can make and should have salary income. I do believe that our ultimate financial goal should be making enough passive income to fund a dignified lifestyle. This brings the opportunity to experience life to the fullest as we desire. So regardless of what your current situation (Employee, Self-employed, Businessman, Investor, or Unemployed) is, start thinking, take control, and make little progress in every income stream type.

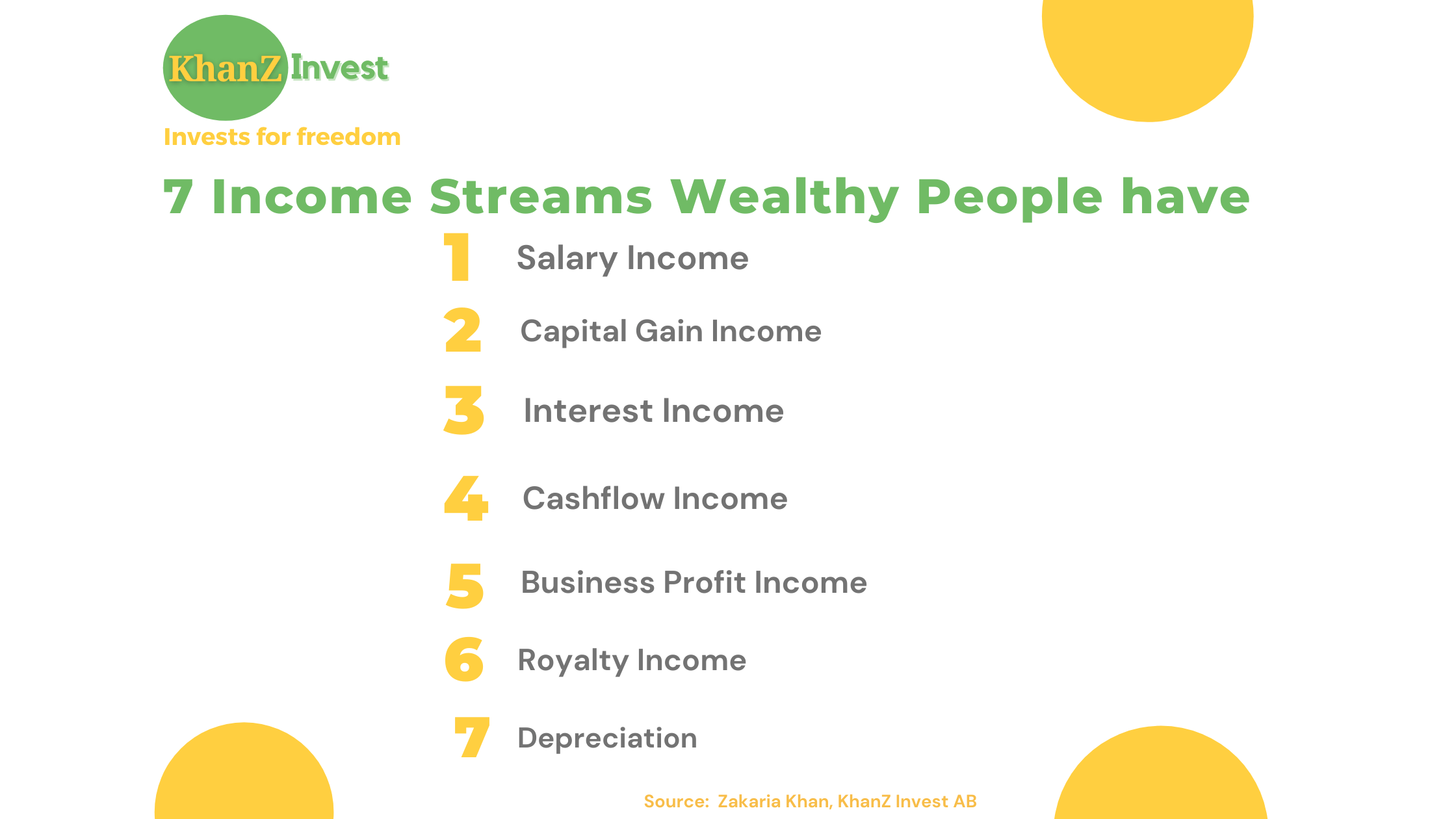

Stream 1: Salary Income

Salary Income is an active income source and the most common type of income in this world. Since childhood, we are conditioned to make money this way. Society teaches us to go to school, work hard, get good grades, get a job, and then you will reach Nirvana!! I agree with this teaching since this process helps us to develop qualities like hard-working, disciplined, goal-oriented, competitive, teamwork, and many more. I personally think that everyone should get a job in the early stage of their career to learn about the industry, to learn how complex real-life problems are solved, to learn the process for end-to-end value delivery. More importantly, to earn money and save capital for future ventures and investments. I have worked in jobs for 10+ years, saved a good amount of capital before I dared to completely move out of salaried income.

The issue I have with salaried income is the social stigma attached to it. I often see and personally experience that society judge and treat people based on their job or salary. If someone does not have a salary they are generally useless and someone holding an attractive job title is respected and loved. This leads us to a race to chase a job title even if we don’t like the job itself, a race to climb the corporate ladder even at an expense of our values and morals. Eventually, we lose our creativity and even worse lose self-identity. I keep telling myself, do a job if you like the job itself not for the title. If you do it for the title then the only justification is that you need to pay the bills and this is just an intermediate step to build the life you want for yourself.

Currently, I don’t pay any salary myself because I don’t plan to borrow credits nor do I plan to take social benefits. Credit qualification (eligible to borrow money) and Social benefit (i.e. sick leave, parental leave, child care, etc) require a salary. The amount one can borrow or the compensation as the benefit is calculated based on the salary. I plan to start paying myself a salary again later if I wish to take credit or start a family/have kids

Stream 2: Interest Income

Interest income is a passive income source and perhaps the most commonly earned passive income. When we keep our saved currency in the bank, we earn interest on that savings. There are different schemes, one earns more money if they keep their currencies for years than for the short term. It is very important to have some high liquid assets/cash in hand all the time for unexpected emergencies. Let’s say 1-2 months’ living expenses. In addition to that we should also have a margin of safety, let’s say another 3-6 months of living expenses. I would not suggest having so much cash in a saving account just to earn Interest Income. Over time currency loses purchasing power due to inflation. Unless, the interest rate is higher than the inflation, in the real terms you are not really making any income rather slowly losing it.

In Sweden, most saving accounts don’t pay any interest. It is possible to find a 0.5% interest savings account though. The target inflation rate of Sweden is around 2%. So, saving in cash is a guaranteed loss. Government bonds/treasures are also no good as the yield is lower than the target inflation. We should find a better way to preserve our savings. I keep some marginal cash for emergencies and chose not to make any interest income on those.

Stream 3: Capital Gain Income

Most of us dream to be a homeowner and yes we should. The most common capital gain income for us is an appreciated home price. Our pension fund often holds a significant amount of stocks. Even we don’t actively manage or see our investments in the pension fund, we are always benefited from the capital appreciation of that portfolio. Capital gain is paper income and something we can not spend unless otherwise we sell the assets and cash out.

Me being an investor, a large portion of my income comes from capital gain. KhanZ Invest currently holds both residential and commercial (hotel) real-estate in Sweden. I also hold properties in Bangladesh including lands. If you own land, try to make that a cash-producing asset by making firms, fisheries, gardens, or just planting trees for long-term cashout.

Since I have worked in jobs for years, I have earned some Swedish pension. Luckily, that portfolio is slowly but surely increasing in value.

My investment company, KhanZ Invest AB, also invests in stocks. This section of the business is new and we hope to grow over time.

Stream 4: Cashflow Income

Most of my income today are coming from the Cash-Flow Income source. This is a passive income stream. Rental income (i.e. rent from home/hotel/cars etc) is an example of passive income. Another passive income is cash dividends coming from stock holding. Often dividends are referred to as truly passive income since this income does not require any active maintenance. Rental income might require active property management.

Currently, my cash-flow income is more than my cost of living in Sweden. I had a goal (F.I.R.E) Financial Independence Retire Early. That goal is realized and now I am moving forward towards the next level of the plans.

Stream 5: Royalty Income

Royalty/perpetuity income is also a passive income source. It is mainly income from licensing deals. If you have innovations, websites, write a book, make/write a song, take a photo, draw cartoons, write articles and make a deal with the publisher that depending on the sell/use of the asset, you as the owner/Copywrite holder will receive a certain percentage of that sale. Cashflow income generally requires large capital. Royalty income needs more creativity to generate the asset which can be licensed. If you make a youtube video and earn money via advertisement, that is also royalty income

I used to make royalty income through writing articles and even earned a few pennies from photographs. Currently, I don’t make any royalty income. I closed that income source to free some time from my daily schedule so that I can start giving time to build KhanZ Invest’s online presence.

Stream 6: Business Income

Business income can be divided into 2 different types of income. Type-1 is the intrinsic value of the business and Type-2 is the net profit coming from the business. Type-1 income is more like Capital gain income, it is on paper. You can not spend it unless you sell the business.

Type-2 business income can be both active and passive. If you are a freelancer/consultant and selling your knowledge as a service then this is an active source of income since the revenue is directly dependent on the number of hours you are spending.

On the other hand, if you build a system of selling pet foods on amazon.com where Amazon takes care of the supply chain then the revenue is not directly dependent on how many hours you are spending. Here, you own a system thus this source of income is a passive income source. Shall the business grows and an effort to hire a manager, then it’s like a dividend passive income source.

In the very early days, I made both active and passive Type-2 business income. Active type-2 was some consultancy around IPR and Business development and passive was through outsourcing services and Air BnB. Currently, I closed all my Type-2 (active and passive) business income sources to free some time from my day and spend that time elsewhere.

Stream 7: Depreciation Income

Depreciation is the opposite of capital gain income. It’s actually a capital loss in the paper for business. If your business owns property (office building/cars etc) and/or plants (factories) you can depreciate its value on paper and show it as a loss. This is allowed because property and plant have a life cycle and after the end of the cycle the property/plant is expected to be dismantled and replaced. The maximum depreciation allowed per item is determined by the government’s tax authorities. The question here is How come loss can be a source of income? Since it is a loss for the business, net income can be adjusted with that and you shall get a tax refund.

How can you take advantage of this even if you don’t have a fully operational business? One way to do that is by opening a solo trade (one-person company). Usually opening a Solo Trade company does not cost any money in most countries. Later, you can buy your car, computer, and other work-related discretionary items and depreciate the value over time. This should give you some Tax refund thus increasing your net annual income.

KhanZ Invest owns commercial real estate thus can depreciate its properties if wishes. Currently, I use this tool as an income.

What am I missing

I was lucky to be able to make money in all 7 ways. Currently, I am missing Interest Income, Royalty Income, and Type-2 Business income. So I have 4.5 out of 7. I closed some income sources to free some time from my daily schedule and utilized that free time to restructure and build other parts of the business. In long run, I will reopen the closed income sources except for Interest Income. I will have 6 out of 7 types of income sources for me. For religious reasons, I prefer to stay away from Interest Income when possible, at least for the time being.

So regardless of where you are in your life (E/S/B/I or Unemployed), start thinking of adding multiple income sources and become financially independent faster. Start an income source even if it is very small, over time that might grow big. The less active time we will spend on making money; the more free time we will have for ourselves. We can use that time to do other things that we value. For some, it’s quality time with your kids and family, for some it is traveling and exploring the world and for some, it is just a cause that matters to us. Find out what works for you and take action.

#FinancialIndependence #KhanZInvest #investment #cashflow #dividend

Disclaimer: I, Zakaria Khan, or KhanZ Invest AB does not provide financial advice. I am only sharing my point of view for your education, fun, and entertainment purposes. You should do your own study and/or consult your licensed financial advisor before making financial decisions

Pingback: https://pinshape.com/users/2462910-order-stromectol-online

Pingback: best canadian mail order pharmacies

Pingback: canadian pharmaceuticals

Pingback: stromectol pill

Pingback: https://500px.com/p/bersavahi/?view=groups

Pingback: canadian pharmacy meds

Pingback: www.provenexpert.comcanadian-pharmaceuticals-online-usa

Pingback: sanangelolive.commemberspharmaceuticals

Pingback: melaninterest.comusercanadian-pharmaceuticals-online?view=likes

Pingback: canadian pharmacies online

Pingback: canadian pharmacies mail order

Pingback: experiment.comuserscanadianpharmacy

Pingback: canadianpharmacy

Pingback: https://challonge.com/esapenti

Pingback: challonge.comgotsembpertvil

Pingback: challonge.comcitlitigolf

Pingback: stromectol

Pingback: order stromectol over the counter

Pingback: stromectol biam

Pingback: is stromectol safe

Pingback: https://inflavnena.zombeek.cz/

Pingback: www.myscrsdirectory.comprofile4217080

Pingback: https://supplier.ihrsa.org/profile/421717/0

Pingback: canadian pharmacy world

Pingback: canada online pharmacy

Pingback: moaamein.nacda.comprofile4220180

Pingback: Canadian Pharmacy USA

Pingback: network.myscrs.orgprofile4220200

Pingback: canada pharmacies online

Pingback: medicament stromectol

Pingback: www.ecosia.orgsearch?q="My Canadian Pharmacy - Extensive Assortment of Medications – 2022"

Pingback: https://www.mojomarketplace.com/user/Canadianpharmaceuticalsonline-EkugcJDMYH

Pingback: prescription drugs without prior prescription

Pingback: https://www.giantbomb.com/profile/canadapharmacy/blog/canadian-pharmaceuticals-online/265652/

Pingback: legitimate canadian mail order pharmacies

Pingback: https://search.gmx.com/web/result?q="My Canadian Pharmacy - Extensive Assortment of Medications – 2022"

Pingback: northwest pharmacies

Pingback: order stromectol online

Pingback: canadian rx

Pingback: canadian pharcharmy online

Pingback: https://www.dogpile.com/serp?q="My Canadian Pharmacy - Extensive Assortment of Medications – 2022"

Pingback: https://search.naver.com/search.naver?where=nexearch

Pingback: top rated online canadian pharmacies

Pingback: www.bakespace.commembersprofileСanadian pharmaceuticals for usa sales1541108

Pingback: prescriptions from canada without

Pingback: https://results.excite.com/serp?q="My Canadian Pharmacy - Extensive Assortment of Medications – 2022"

Pingback: www.infospace.comserp?q="My Canadian Pharmacy - Extensive Assortment of Medications – 2022"

Pingback: headwayapp.cocanadianppharmacy-changelog

Pingback: results.excite.comserp?q="My Canadian Pharmacy - Extensive Assortment of Medications – 2022"

Pingback: https://canadianpharmaceuticalsonline.as.me/schedule.php

Pingback: https://feeds.feedburner.com/bing/stromectolnoprescription

Pingback: reallygoodemails.comorderstromectoloverthecounterusa

Pingback: aoc.stamford.eduprofilecliclecnotes

Pingback: https://pinshape.com/users/2491694-buy-stromectol-fitndance

Pingback: https://www.provenexpert.com/medicament-stromectol/

Pingback: buy stromectol fitndance

Pingback: theosipostmouths.estranky.czclankystromectol-biam.html

Pingback: tropkefacon.estranky.skclankybuy-ivermectin-fitndance.html

Pingback: www.midi.orgforumprofile89266-canadianpharmaceuticalsonline

Pingback: dramamhinca.zombeek.cz

Pingback: sanangelolive.commembersthisphophehand

Pingback: https://motocom.co/demos/netw5/askme/question/canadian-pharmaceuticals-online-5/

Pingback: northwestpharmacy

Pingback: buy stromectol online

Pingback: https://orderstromectoloverthecounter.mystrikingly.com/

Pingback: generic stromectol

Pingback: buystromectol.livejournal.com421.html

Pingback: orderstromectoloverthecounter.flazio.com

Pingback: https://search.lycos.com/web/?q="My Canadian Pharmacy - Extensive Assortment of Medications – 2022"

Pingback: conifer.rhizome.orgpharmaceuticals

Pingback: stromectol drug

Pingback: graph.orgOrder-Stromectol-over-the-counter-10-29-2

Pingback: https://orderstromectoloverthecounter.fo.team/

Pingback: https://orderstromectoloverthecounter.proweb.cz/

Pingback: stromectol new zealand

Pingback: https://sandbox.zenodo.org/communities/canadianpharmaceuticalsonline/

Pingback: demo.socialengine.comblogs24031227canadian-pharmaceuticals-online

Pingback: pharmaceuticals.cgsociety.orgjvcccanadian-pharmaceuti

Pingback: URL